The gold market is shocked!The price spread was suspected of being "besieged"!Intersection

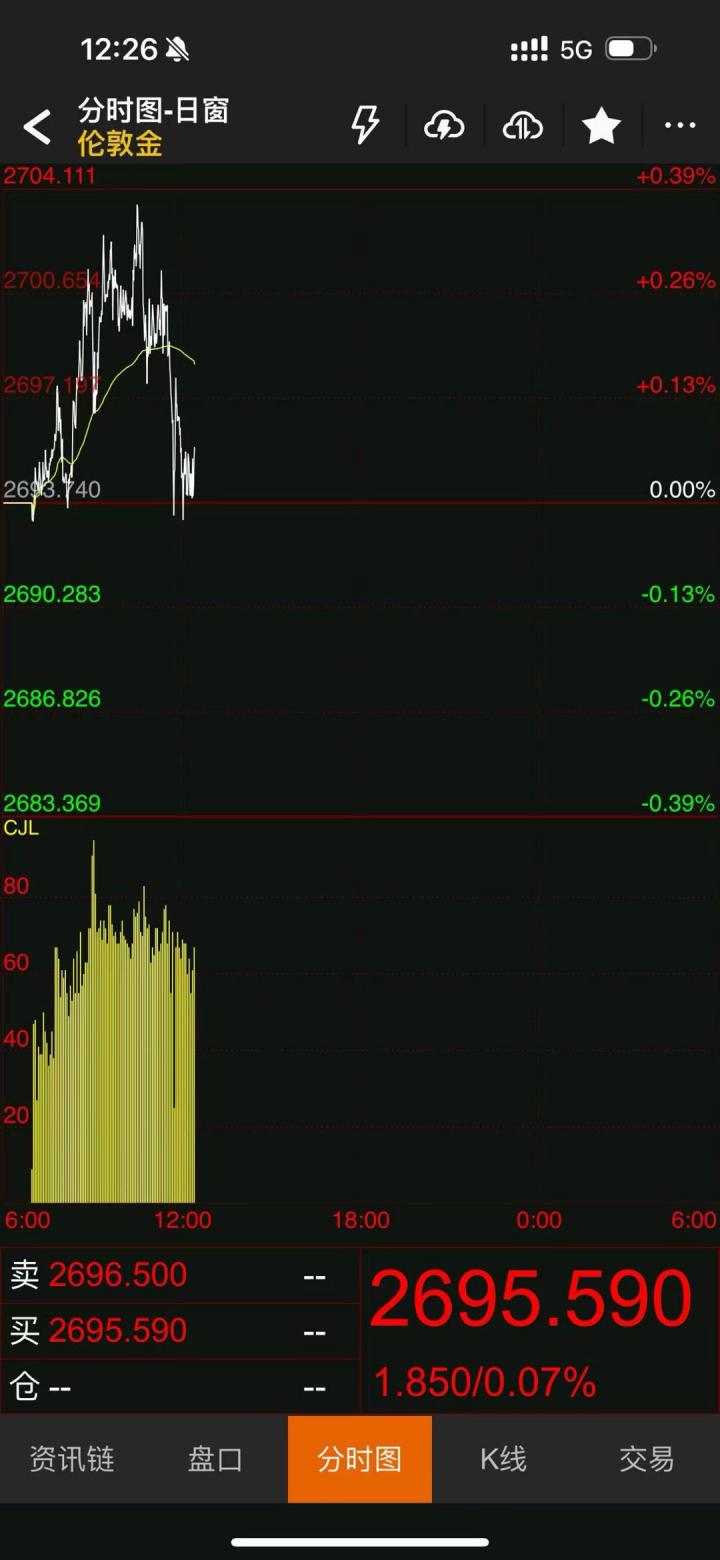

Today, we have observed a significant price differentiation between the gold futures and the spot market. This differentiation directly triggered the severe volatility of the difference in the spot market.

This phenomenon is not a solitary case, but a general trend in the entire market, and major liquidity providers (LP) have been affected.

Further analysis, this phenomenon of price differentiation and differences is closely related to the chaos of international futures and physical (EFP) market transactions.

Due to the abnormal trading activities in these markets, the difference between the differences in precious metal products has expanded, and this situation has affected all liquidity providers and Taiwanese businessmen.

At present, international traders are enthusiastically discussed the phenomenon of price differences today.

The primary factor may be the shortage of physical golden supply;

Secondly, the price difference between the price of Golden Electronic disk trading funds (Exchange-Fundedproduct (EFP) (EFP) has significantly expanded, which may cause a serious squeezing effect on short positions, the so-called "short hanging".

IG Group Analysis: The current price difference between the gold and silver period is attributed to the market liquidity challenge

It is reported on December 11 that the IG Group of the financial institution pointed out that the large number of current prices in the recent major period of gold and silver markets are the root cause of the disconnection between the spot and the futures market.Expand the transaction price difference.In order to maintain the smooth progress of market transactions, the IG Group has adjusted the maximum difference settings in a timely manner.It is worth noting that this problem is a challenge generally facing the entire market, not the unique to IG Group.

The analysis of IB · Yingyou Securities revealed that the current price difference between the market period of the gold and silver market is caused by the disconnection of the spot and the futures market, and the liquidity provider (LP) has greatly adjusted the difference accordingly. This phenomenon is a common problem in the market.

CMCMARKETS professional analysis: The current price difference between gold and silver market is attributed to the failure of the spot and the futures market, prompting the corresponding expansion of liquidity providers (LP), this problem is highlighted as the general challenge in the market.

LMAX In -depth analysis: The current price difference between the gold and silver market is expanded from the failure of the spot and the futures market linkage mechanism, and the liquidity provider (LP) has therefore adjusted the quotation range to cope. This phenomenon is a common problem in the market.In response to the reasons for the spread, there are two mainstream speculation in the market: one is the shortage of real gold, and the other is the price difference between the gold electronic disk trading fund (EFP) significantly expanded, and then a severe squeezing effect on the short position position, that is, the "empty position forced warehouses for warehouses"" ".

In this case, we remind all customers to pay close attention to their account funds and positions in order to avoid the risk of violent fluctuations in the market in time.