Brokerage JDR suspicious points!Play the "Gift Gold" scam?What is the so -called supervision?

JDRSECURITIES Introduction

JDRSECURITIES is an Australian broker that entered the country in 2021 and claimed to be in 3 domestic team offices, which are located in Shenzhen, Shanghai, and Beijing.It is a diversified international financial service group, which includes (but not limited to) the online deposit foreign exchange transaction and derivative transactions.

As a broker that has just entered the Chinese market, JDRSECURITIES has been using the "Getting Gift Activities" for a long time to attract customers to expand its influence.The "Gift Gift Activities" are all calculated based on the number of binding transactions in the amount of gold, and rewards are uniformly distributed after the event!This is a more common marketing method for securities to lure gold.

Get a gold scam?Question!

Recently, JDRSECURITIES's gold -seduce means have caused dissatisfaction and doubts of many investors!

In just a few months, JDRSECURITIES was repeatedly exposed to complaints. The platform used "Gifts" to seduce investors to enter the gold. After the event, a malicious deduction of "Gift Gift" and the customer's funds were not allowed to pay gold!

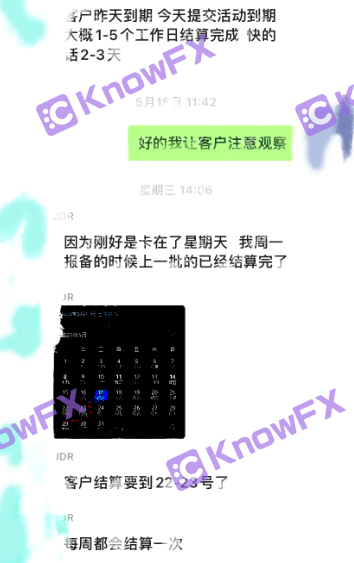

Huiyou Chen appeared to say that in April this year, he completed the registration of the "event" under the guidance of a client manager of JDRSECURITIES.And according to its guidelines, there was no violation of regulations and was confirmed by the client manager, but Huiyou was told that the call was not toved to the reward on the day of the "Gift Gift" and did not give a reasonable explanation at the same time!

This problem has not been resolved so far. To be precise, JDRSECURITIES is notified after notifying. Even if there is no positive response to the complaint from beginning to end, it really puts on a stance of dead pigs and is not afraid of boiling water!

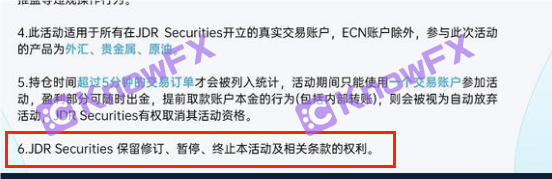

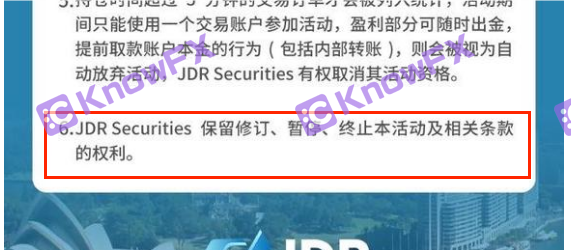

Knowing that Brother also read the briefing of the past event of JDRSECURITIES.It is found that all of its activities are "reserved the right to revise, suspend, terminate this activity and related clauses." This means that JDRSECURITIES can completely change the game rules of the event and terminate the activity at any time.This is the shameless overlord clause!

Regulatory information

Considering the shameless behavior of JDRSECURITIES, I know that my brother has to doubt whether there is a sloppy behavior in all aspects of compliance!Next, come to dig a little bit.

It can be seen on the official website of JDRSECURITIES that four group entities are distributed around the world, of which:

JdrTechptyltd

JDRTECHPTYLTD, located in the Australian capital Sydney, is a financial technical service provider. Its mainly responsible for services including trading platforms, CRM and server management.After understanding, I checked that the company did not have financial licenses and did not participate in market transactions!Therefore, there will be more introductions here.

JDRSECURITIESPTYLTD

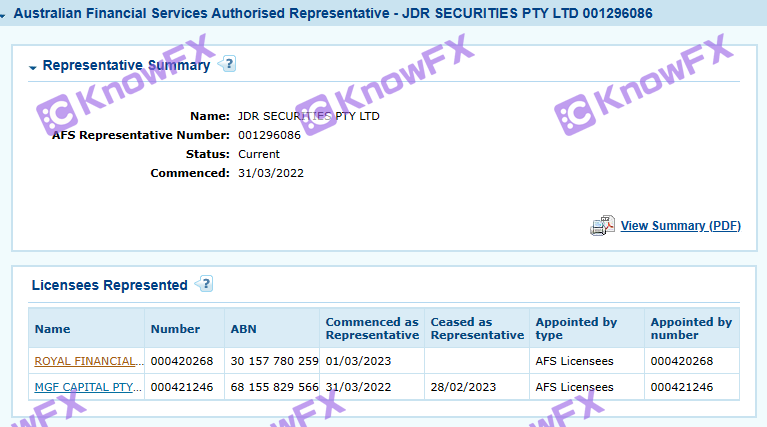

JDRSECURITIESPTYLTD is different!It is also in Australia and claims to hold the Australian ASIC regulatory license.However, Australia ASIC is affected by my country's foreign exchange control, and has long banned domestic investors from opening an account under its supervision.And it holds AR licenses by ASIC ASIC, which is actually held by a licensed company RoyalfinanCialtrandingptyltd!

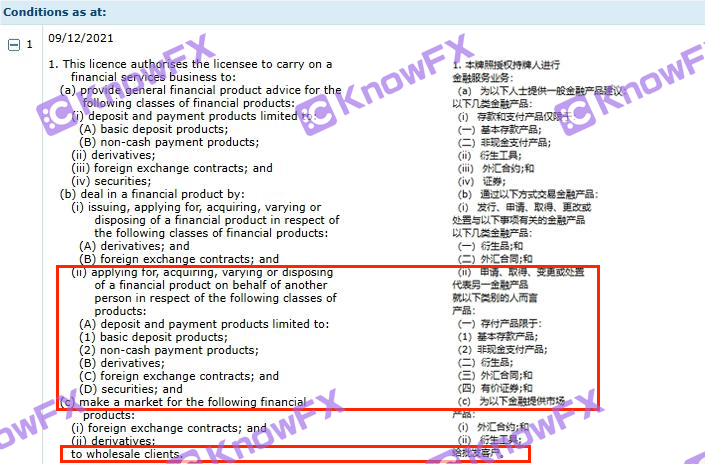

It is worth noting that although the type of license can be traded is rich, the license only gives the right to serve the wholesale customers.This means that the company of JDRSECUREITIESPTYLTD will not only be supervised by Australia ASIC, but also cannot serve ordinary retail customers.Therefore, the company is not a qualified entity for trading investment!

Two JDRSECURITIESLITED?

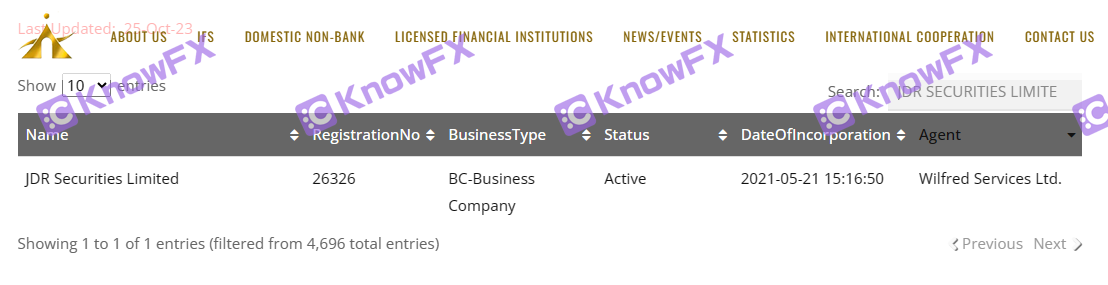

Finally, there are two companies that have the same name JDRSECURITIESLIMITED, which are located in New Zealand and San Vincent, respectively, claiming to be supervised by the New Zealand FSP and St. Vincent FSA!

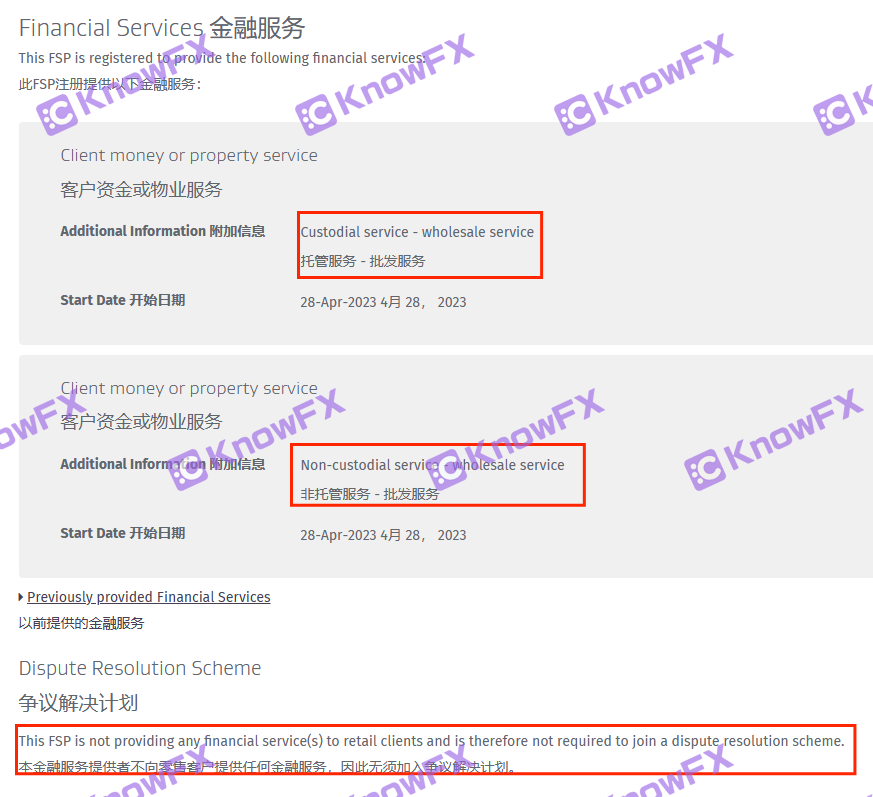

Among them, JDRSECURITITIESLITED in New Zealand was indeed regulated by New Zealand FSP.This license also gives them two services two services, but this license still only serves wholesale customers!In other words, if retail customers trades through the company, it is super limited, it is illegal and illegal acts and regulations are not protected by the New Zealand FSP supervision!

San Vincent FSA does give local JDRSECURITIESLIMITED regulatory licenses!But the old man of San Vincent FSA should know well that he does not supervise foreign exchange and binary options at all, and the same is true for new forces cryptocurrencies.It is still a offshore regulatory agency with relatively weak regulatory capabilities!Therefore, the company is not a qualified entity.

In summary, JDRSECURITIES has three companies with licenses and supervision, but whether it is Australian ASIC AR license or New Zealand FSP regulatory license can only serve wholesale customers;

Only JDRSECURITIESLIMITED, which is subject to San Vincent FSA, can serve ordinary customers who serve the retail end!But even if the supervision of St. Vincent is useless, it is also not guaranteed!

Trading platform

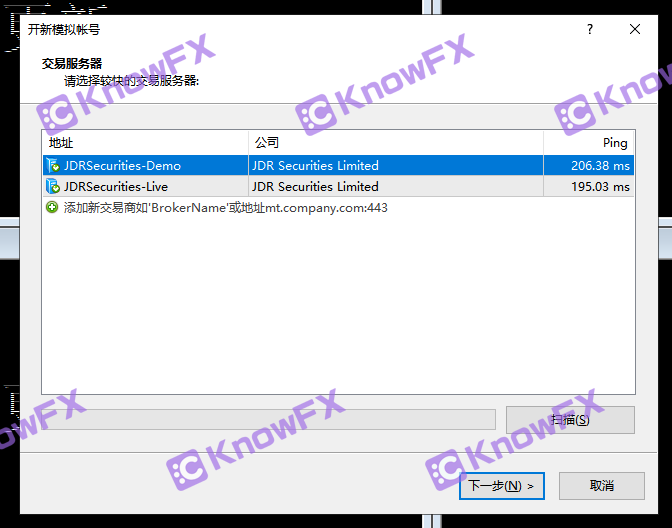

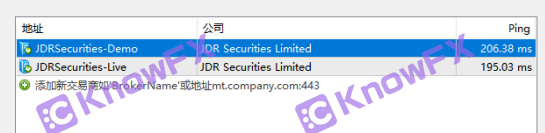

The company registered by JDRSECURITIES on the MT4 platform is the JDRSECURITITIESLITED company supervised by San Vincent FSA and traded!So how does the two regulatory companies under the supervision of San Vincent FSA conduct foreign exchange transactions?

The fact is obvious!Although the San Vincent FSA does not regulate foreign exchange, it cannot be said that it is over -limited, but the foreign exchange transactions of JDRSECURITIES have indeed been unsuitable and cannot be guaranteed! Even the brokers misappropriated the customer's funds at will during the transaction process at will during the transaction.It's hard to be aware of it, it is really like entering the law!

Other doubts

JDRSECURITIES still has many suspicions but to be tapped. The following is some doubts after understanding Brother's observation:

Is it suspected of confusion with the company with the same name?

Brother who knows that there are often many licensed entities in the global exhibition industry. In order to facilitate and screen brokers, they often deliberately distinguish each entity name!Companies such as JDRSECURITIES who use the same name directly are often to confuse the evasion of supervision!

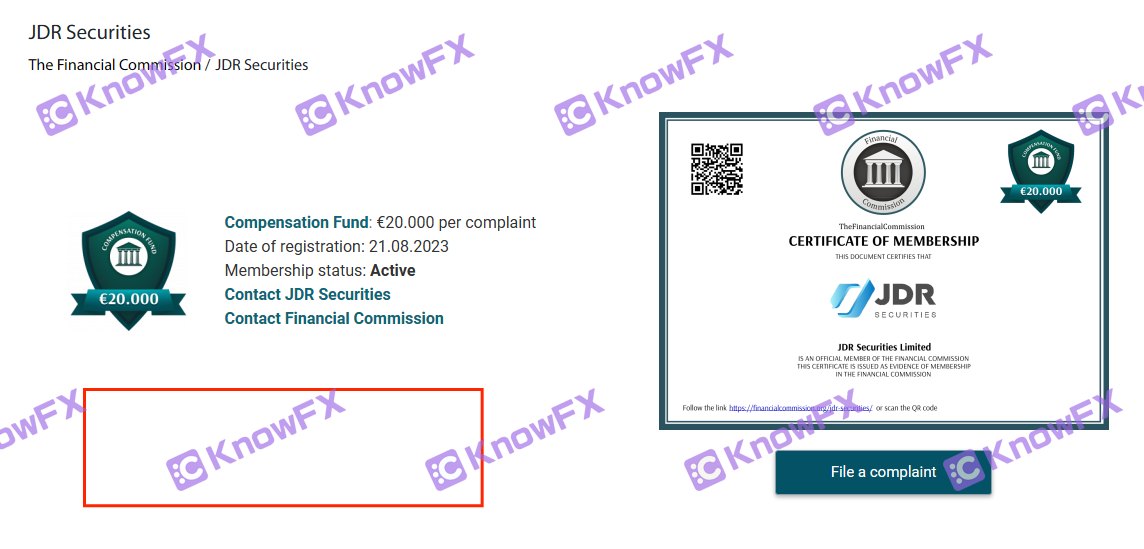

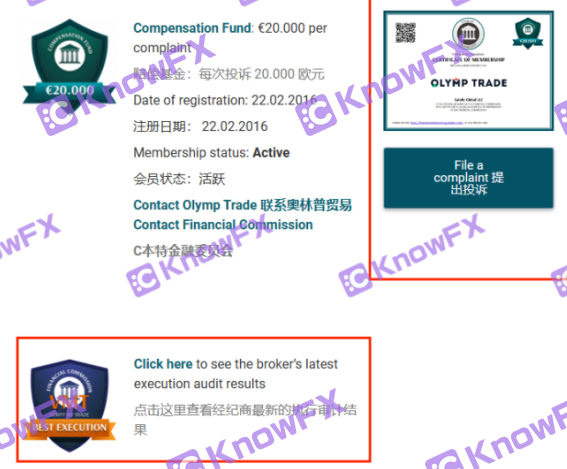

For example, the identity of its financial committee ("TheFinancialcommission".In its specific authentication physical information, it is completely impossible to identify who is a member of the financial committee's certification!

Is the financial committee's identity just furnishing?

At the same time, I know that Brother also found that although JDRSECURITIES has many complaints in the past, it has not been paid through the Financial Commission because there is no relevant record on its homepage!Knowing that Brother has to doubt its membership is just used for furnishings!

Is there only a Chinese server in the global exhibition broker?

There is also JDRSECURITIES as a broker that officially entered China in 2021!The two servers used in transactions are in China!This point is obviously not in the same time that it has not been able to work overseas for many years before entering the domestic market!

Summarize

A series of "Gifts" activities of brokers JDRSECURITIES have the overlord clauses, and they have never been effectively handled with deception!At the same time, there is only JDRSECURITIESLITED under the supervision of St. Vincent FSA, which does not regulate foreign exchange FSA, which can serve the retail terminal, which is extremely risky for investors in foreign exchange transactions!At the same time, I know that Brother suspects that it has confusing the company's entity, the main body of compensation, and the exhibition area!

Finally, if you need to check the platform, disclose clues, and complain, please scan the code to add a detective QQ to make the news!

You need business cooperation, please scan the code and leave the aircraft number to cooperate!

Query platforms, complaints, more information, please download the Hui APP