Santander has been punished frequently by regulatory agencies, and the company's main body is easily confused

Recently, Poison Tongue Jun found a bank with a full -scale license in the UK. Santander Britain is a large -scale retail and commercial bank headquartered in the UK and a wholly -owned subsidiary of Banco, a world's major banks in the world.I also saw this bank customer's complaint, let's check it down!

1. Anti -money laundering omissions lead to fines

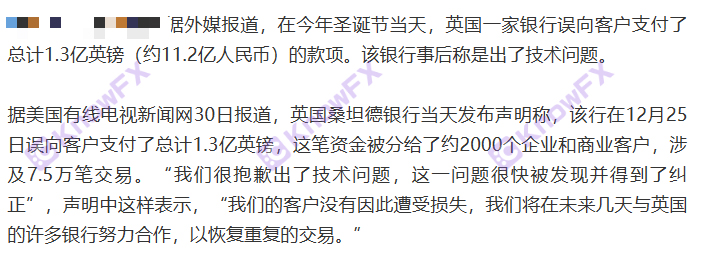

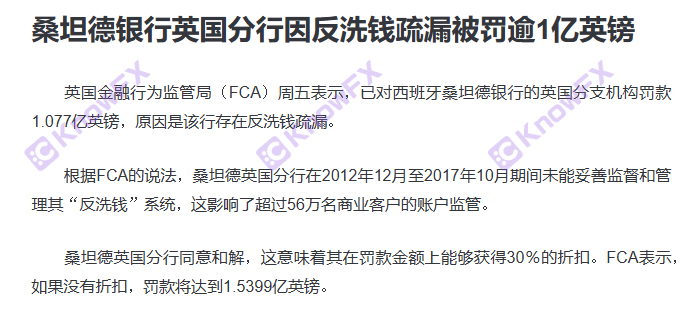

Earlier, the British Branch of Santander paid 130 million pounds of £ 130 million in the British Branch, which later said that technical problems were said to have occurred.Santande Bank British Branch was fined 100 million pounds for anti -money laundering. The role of banks was to protect customers' funds and supervise the source of funds.

2. Punishment of British FCA regulatory punishment

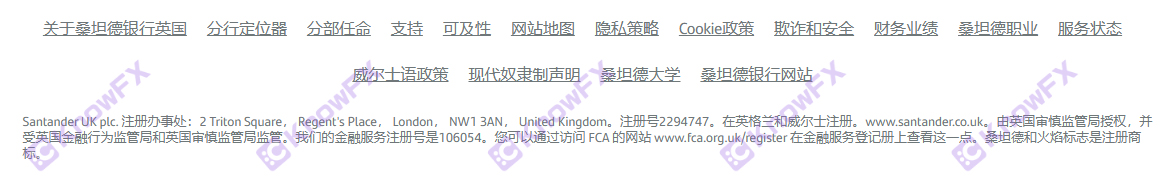

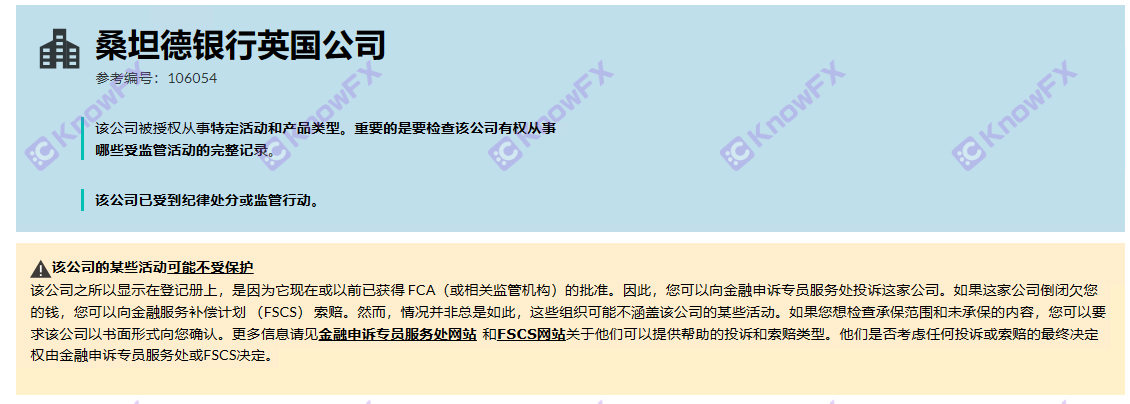

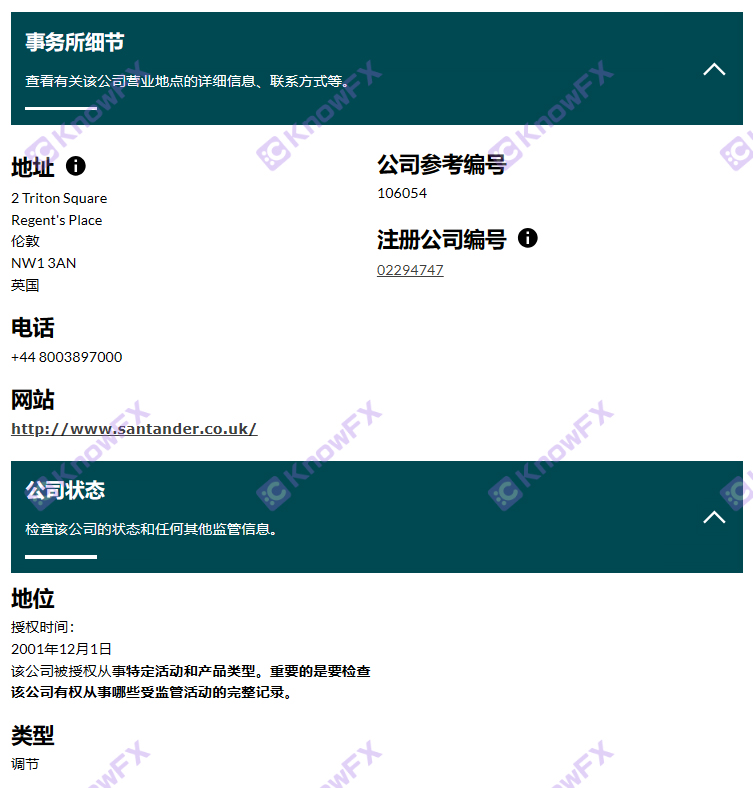

SANTANDERUKPLC is supervised by the British Financial Behavior Regulatory Administration (FCA). The regulatory number is: 106054

Santanderukplc was indeed supervised in the UK (FCA).

However, there are differences between commercial banks and other foreign exchange dealers. The mature foreign exchange market needs to provide a series of financial services to institutional investors and other investors. Commercial banks providing services are called main brokers.

One series of service centers is the most basic divided into: settlement, settlement, settlement, and hosting.

There are also many fines in the FCA's penalty that Santande Bank has been fined multiple times. Most of the reasons for the punishment are violating management control, customer interests, and omissions of anti -money laundering policies.

If the bank does not resolutely implement the policy, it is easy to be used by criminals, which is harmful to all customers.

The money laundering behavior is very harmful. It can transfer and cover the funds obtained by the criminal activities, affect the stability of the financial market, and damage the legitimate income of the legal economy.If the bank does not pay attention to anti -money laundering policies, the money that may enter is the funds harvested by some black dealers to investors. After money laundering, the criminals will be allowed to get away.

If there are so many problems in Santande Bank itself, how dare customers dare to put the funds here.

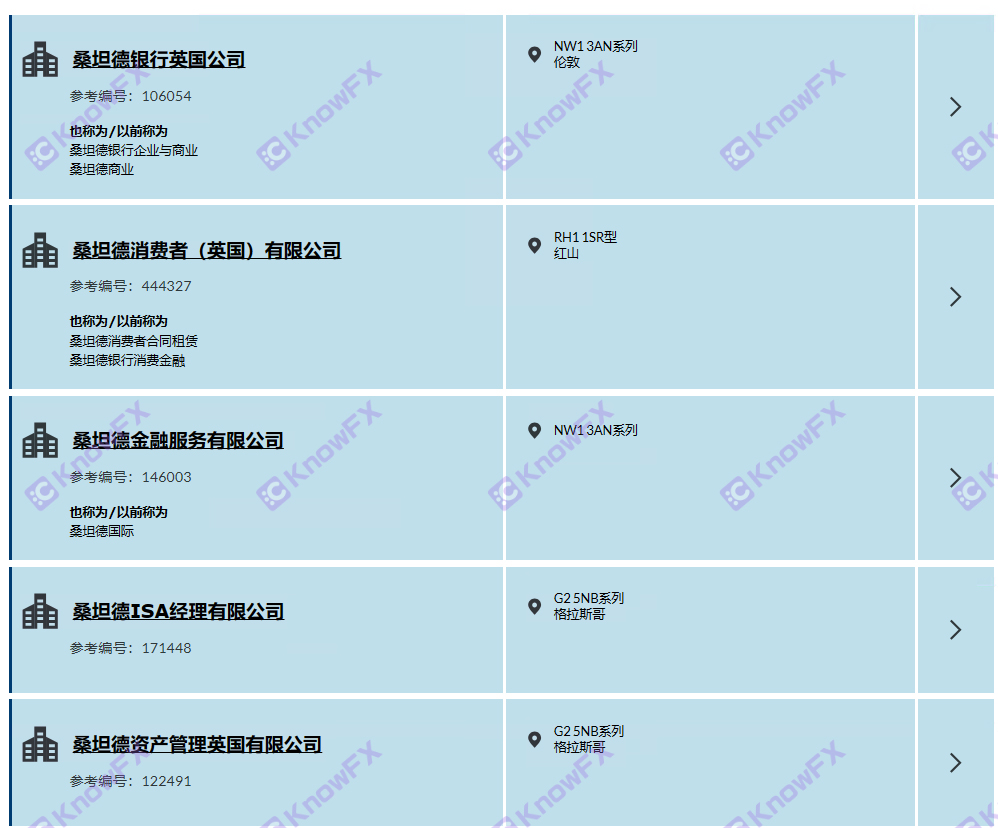

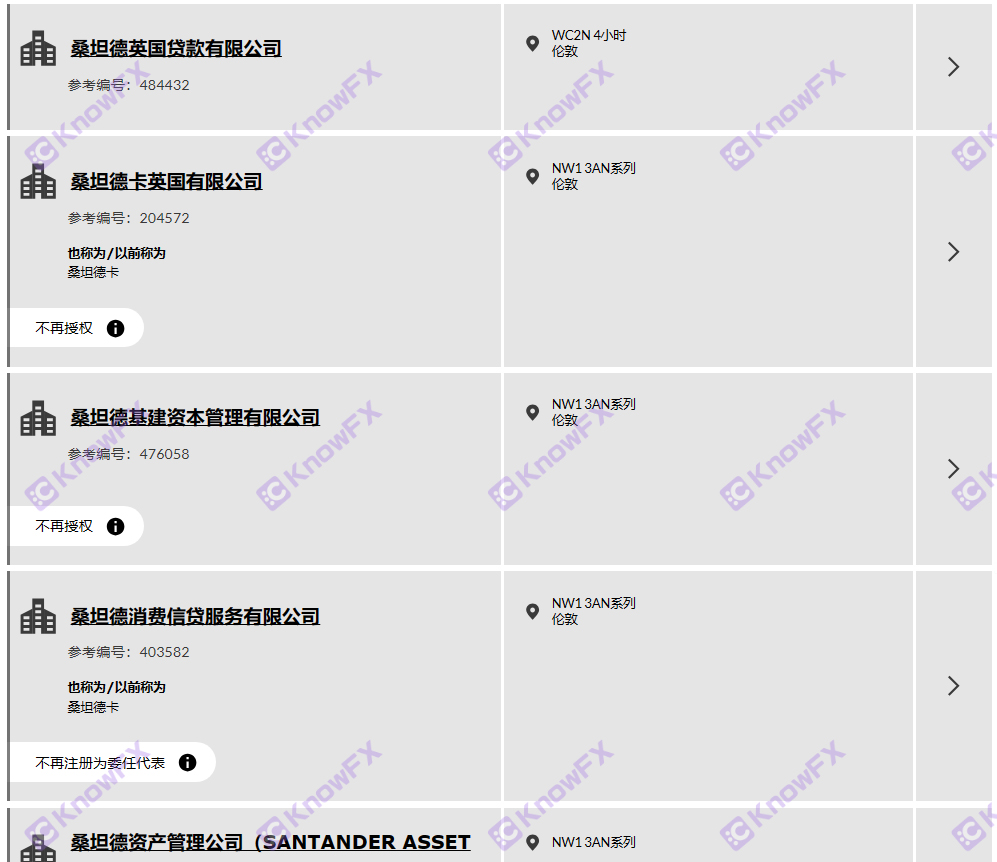

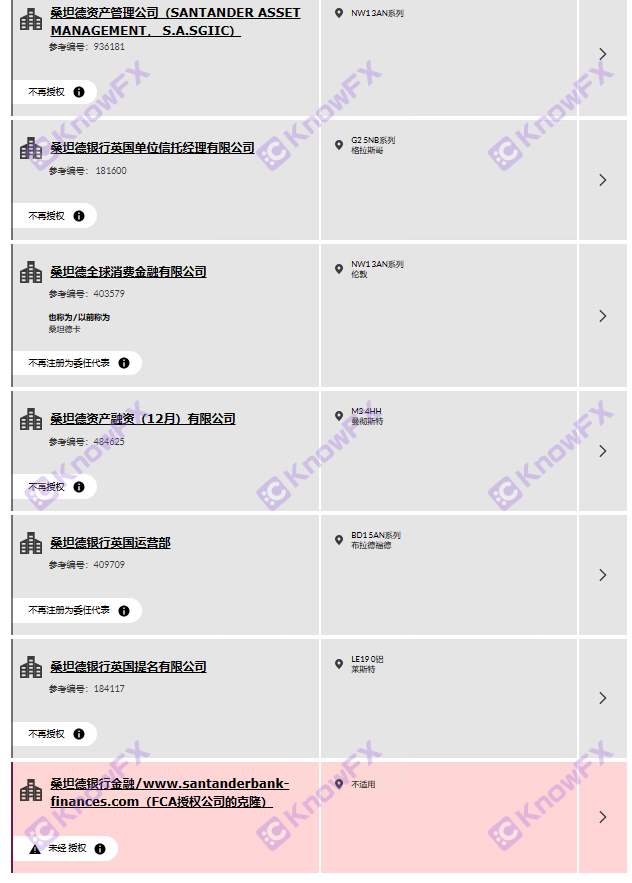

3. The main body of the group company is very easy to confuse

We found that there are many main bodys of Santande from the FCA official website of the United Kingdom. The scope of supervision accepted by each company is different.Experience customers are also very easy to confuse, resulting in deception.

There are also companies such as "Santandeka UK Co., Ltd. and Santant Infrastructure Capital Management Co., Ltd." that are no longer authorized and unauthorized.It will not be regulated by the British FCA.

In summary, you want to go to some platform transactions. First of all, under the premise of regulatory licenses, you should also pay attention to the leverage multiple, signs of slippery point, or whether there is a problem of gold, such as the lever multiple of the British FCA regulatory requirements.It must not exceed 1:50, and the maximum precious metal must not exceed 1:20.If the platform multiple is 1: 200, then you must pay attention. Whether such a platform will run at any time, so judging the quality of a platform, there are many places, you must consider carefully before investing.

Detective: 3464399446

Truth: 3147677259

Poisonous tongue: 2389671330

Know brother: 2124228721

If you need to check the platform, disclose clues, and complain, please scan the code to add a detective QQ to disclose the news!

You need business cooperation, please scan the code and leave the aircraft number to cooperate!

Query platforms, complaints, more information, please download the Hui APP