Many investors know: HTFX is launched by the running black platform CDG Global!Previously, the cooperation between HTFX and funds DMT Tech has been well known!

However, now HTFX is not satisfied with becoming a part of the capital disk, but chose to operate independently by itself, and set up a number of fraud companies for illegal fundraising!

They thought their scams were flawless, but they were found vulnerabilized by the detective!Reveal their bottom detail today!

1. HTFX big funds

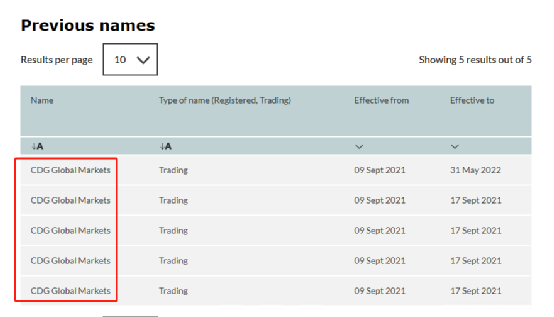

1. Since the inverted CDG Global inverted, HTFX has inherited the CDG Global "mantle" to open the road to deception!

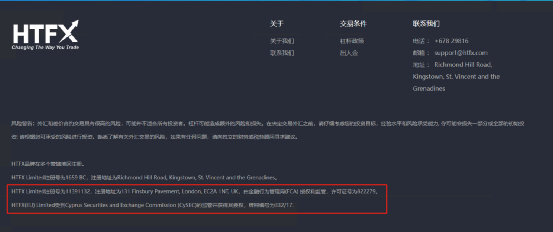

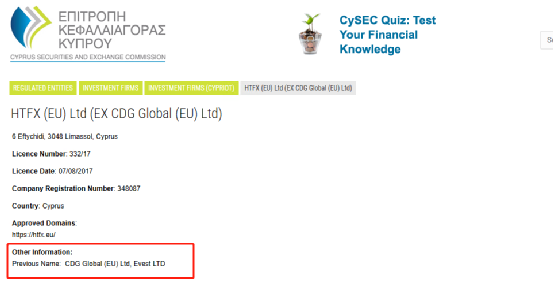

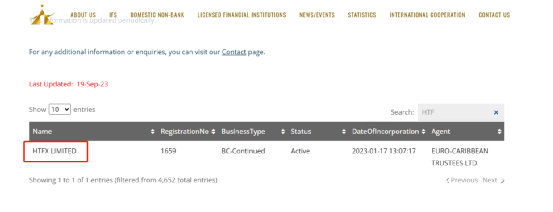

HTFX official website describes: There are 3 companies, two of which are regulated by the regulatory agency. HTFX LIMITED is regulated by the UK, and the regulatory certificate number is 822279; HTFX (EU) Limited is regulated by Cysec, Cyprus, and the regulatory certificate number is 332/332/17.

Let's look down along this clue!

However, it is clear that whether it is HTFX's British license or Cyprus, the main body of these licenses is CDG Global.This approach is typically a deceptive behavior of changing the chives.

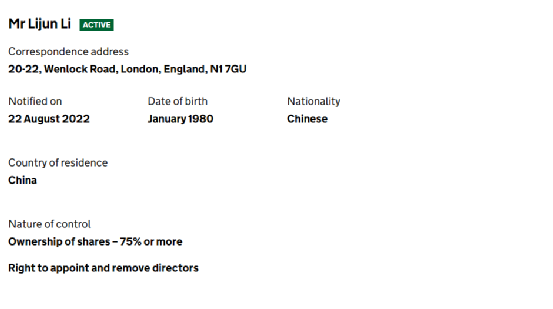

When inquiring about HTFX LIMITED information on the website of the British Industry and Commerce website, the detective found that the company's controller was the nationality of China Lijun Li (Li).Do you say that the good Chinese do not lie to the Chinese?This can undoubtedly show that HTFX makes the black platform for the Chinese and is the same group as the black platform CDG Global!

2. HTFX and fund disk DMT Tech play A and B warehouse routines

Earlier, DMT TECH released official news and HTFX officially reached a cooperation, announcing that it has become the MIB of HTFX!

Let's take a look at the cooperation and specific operations of HTFX and the fund disk DMT Tech:

First of all, DMT TECH is not a brokerage company. Their cooperation model is: DMT Tech claims to be a technology company and only provides trading strategies. Users can choose any one of them provided by many brokers they provide for transactions.Of course, DMT TECH will choose a specific broker in advance in advance, and then use the method of warehouse A and B to deceive.They open accounts by attracting investors to enter the brokerage platform they provided and cut their leek through warehouse operations.

On the surface, DMT Tech and these brokers are operated independently to show multiple options to enhance their strength and credibility; however, in fact, these brokers and DMT Tech are colluded together.HTFX obtains part of the profit from DMT Tech's deception.

Smart investors have noticed a key point: HTFX LIMITED, located in St. Vincent , is the same name as the HTFX LIMITED licensed company in the UK!Their purpose is to confuse audiovisual!After all, Saint Vincent has not regulated foreign exchange transactions!Why is this so?the reason is simple.

In order not to affect its licenses in Britain and Cyprus, the savvy HTFX put all customer funds under the name of San Vincent's HTFX LIMITED company!Even if there are any problems, HTFX's license in the UK and Cyprus will not be affected!

If you look closely, it can be found that the St. Vincent Company was founded on January 17, 2023, and it has only more than half a year.

But now there is no any content related to HTFX, because HTFX is not satisfied with the cooperation model. It has engraved this mode and comes to do it by itself.Others make money!

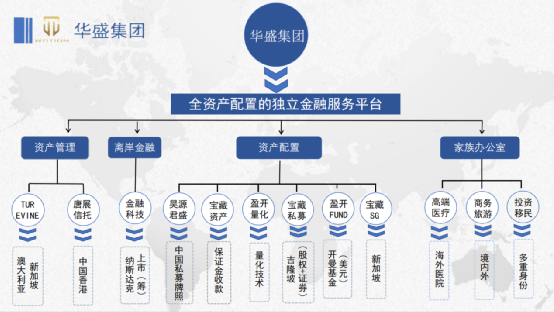

HTFX's new company is called Huasheng Group !

2. Huasheng Group, which is heavy

Let's first look at the genealogy of Huasheng Group Corporation. In the asset allocation, it clearly label its enterprises including: Haoyuan Junsheng, treasure assets, profitable quantification, treasure private equity.1. Yingkai Quantitative Technology/Treasure Assets

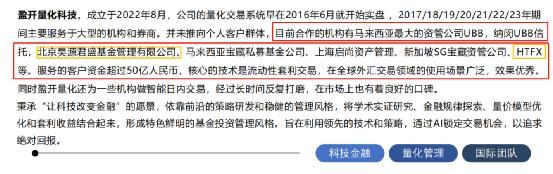

Yingkai Quantitative Technology Corporation claims that it does not serve individual customers, and only a large institution and securities firms. Among them, the cooperative institutions include Beijing Haoyuan Junsheng Fund Management Co., Ltd., HTFX, and Shanghai Qishang Asset Management.

No matter how bragging, all the introductions are emphasizing that HTFX is a reliable brokerage platform, and even the promotion of Huasheng Group will not forget to mention HTFX and focus on promoting the license it holds.However, the registration time of St. Vincent is contradictory with the truth of the previous detectives. Obviously, it is fabricating the facts here!

Looking at Jiang, the general manager of Yingkai Quantitative Technology Company, Jiang Mou's Huasheng Group Company has two: Shanghai Yingkaibao Asset Management Co., Ltd. and Hainan Yingkai Quantitative Technology Co., Ltd.

According to the information changing information, it can be known that Shanghai Yingkaibao Asset Management Co., Ltd. was originally called Shanghai Sanhong Asset Management Co., Ltd., while Hainan Yingkai Quantitative Technology Co., Ltd. holds 99%of the shares.The change time is shown in June this year.

However, the so -called quantitative technology company is actually just a company engaged in software development, and it has nothing to do with real quantitative technology.

2. Beijing Haoyuan Junsheng Fund Management Co., Ltd.

According to the survey on the credit query platform of the third -party enterprise, it was found that the legal representative of Beijing Haoyuan Junsheng Fund Management Co., Ltd. was Liu, and the real director was Li.In the column of partners, a familiar name was found: Li, the person in charge of the British company of HTFX!

These discoveries are not coincidence, all clues are inseparable from HTFX!The so -called group, quantitative technology and private equity funds are just the guise of HTFX's own fabrication!

3. HTFX is suspected of illegal fund -raising!

1. Beijing Haoyuan Junsheng Fund Management Co., Ltd. is illegal!

Before that, it is necessary for you to deal with you how the private equity fund is traded:

First of all, regular private equity funds conduct strict subscription processes, which includes comprehensive due diligence investigations to investors to ensure that the source of funds is legal, does not involve illegal acts such as money laundering, and ensures that investors are in line with subscription qualifications.

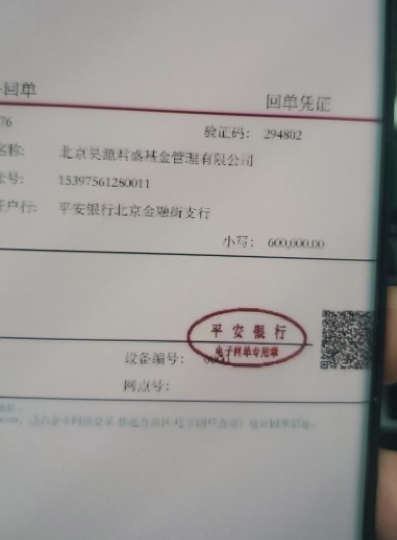

Secondly, in order to ensure the security of funds, private equity funds must cooperate with the trustworthy bank to set up an independent capital custody account in the bank.Investors remit the funds into this regular bank hosting account. Such operations need to be consent from multiple parties to ensure that funds will not be misappropriated at will.

Such subscription processes and fund custody mechanisms are to protect investors' rights and funds, and to ensure the transparency and compliance of transactions.

According to the transfer records provided by investors, funds are obviously directly entering the company's account, not the account of the custody bank .This approach is not allowed and violated.If such a situation is indeed existed and suspected of illegal fundraising, this is a criminal act, and may face legal sanctions, including being sentenced to sentence.

As a regulatory investment tool, private equity funds need to comply with strict laws, regulations, and rules and regulations. Especially in the process of fund management and transaction, the principles of compliant operations and protecting investors' equity need to be followed.If illegal acts are found, investors should report to relevant departments in time and seek legal aid to protect their rights and interests.

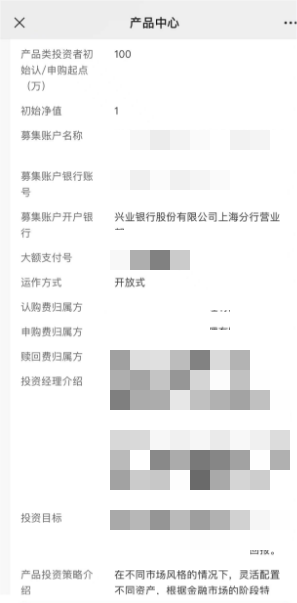

According to the above figure, you can see that the official fund subscription materials include the fund name, the bank account, and the subscription attribution, which is in a clear comparison with HTFX.HTFX may cover its true purposes by turning around and setting a complex structure in order to depend on responsibility when something goes wrong and push the responsibility to the partner.

Here, the detective reminds investors that once you find that there is a problem with the funds subscribed to the fund, or the funds will enter the private account, please stop the payment immediately!According to the law, private equity funds are not allowed to be raised.Therefore, if a private equity fund is raised or in public publicity funds, it may involve criminal acts such as illegal fund -raising, or just a scam with private equity funds as a cover.Investors should be vigilant and carefully choose compliance investment institutions to invest.

2. Beijing Haoyuan Junsheng Fund Management Co., Ltd. does not have a regular license!

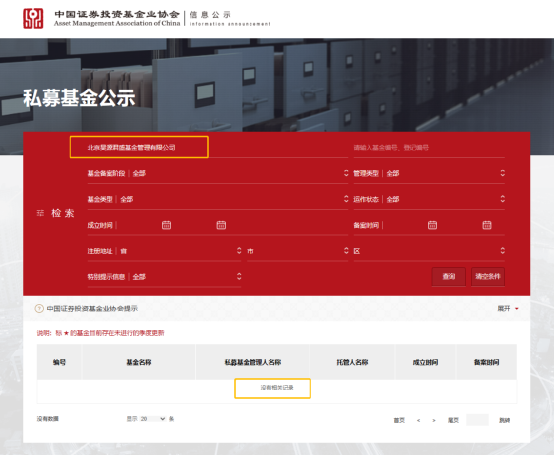

Whether it is a private equity fund, or a private equity and venture capital fund, it should be registered for the record in the China Fund Industry Association.However, in addition to a business license, Beijing Haoyuan Junsheng Fund Management Co., Ltd. cannot provide more content!

Through the official website of the China Securities Supervision and Administration Commission, the Detective did not find any information related to Beijing Haoyuan Junsheng Fund Management Co., Ltd.!

On the official website of the China Securities Investment Fund Association, there is no record information about Beijing Haoyuan Junsheng Fund Management Co., Ltd.!The detective flipped through the entire website and did not query any publicity of the company!

According to the provisions of my country's "Interim Measures for the Management of Securities Investment Fund" and the China Securities Regulatory Commission, the registered fund management company needs to meet the registered capital of not less than 100 million yuan, and shareholders must pay the money funds.According to the business license of Beijing Haoyuan Junsheng Fund Management Co., Ltd., its registered capital is only 50 million yuan, and it does not meet the most basic requirements of the registered fund management company, so it is unsatisfactory.

In addition, if Beijing Haoyuan Junsheng Fund Management Co., Ltd. does not have a fund license and does not publicize and record it, it can indeed show that it may be established for illegal fundraising.Therefore, everyone must be vigilant and do not handle their hard -earned money to unbelievable people or institutions.

Finally, the detective calls on the illegal information of Beijing Haoyuan Junsheng Fund Management Co., Ltd. for private messages.Detective will collect relevant information and report to the relevant departments to report the illegal fund -raising behavior of Beijing Haoyuan Junsheng Fund Management Co., Ltd.

Investment needs to be cautious!Please choose carefully!

Detective QQ: 3464399446

Reprinted the author and indicate the source: https://www.whlinkang.com/4489.html