Crazy and slippery?Restricted gold?

Ruixun Bank, why are you so crazy?

Recently, the detective received a voices in the background: Ruixun Bank did not give gold, and asked investors to do hundreds of hands before giving gold!IntersectionHow can there be such a truth in the world? Is it necessary for investors to say that funds have to be entered?Why can there be conditions for gold?This is simply the overlord clause!This is the black platform!

The purpose of doing foreign exchange trading investors is to make money, so after making money, you can't get money all efforts.Ruixun Bank's behavior has made investors very passive, and the security of funds is not guaranteed. Why is Ruixun Bank so crazy?Don't give gold unscrupulous?Follow the footsteps of the detective and explore it ~

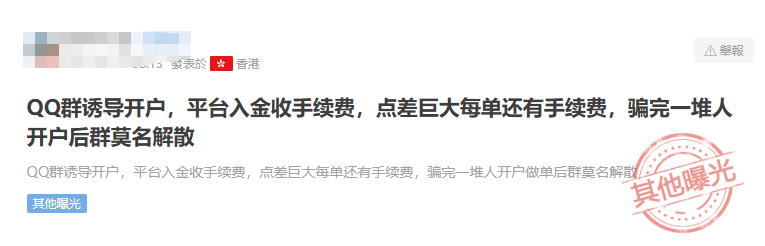

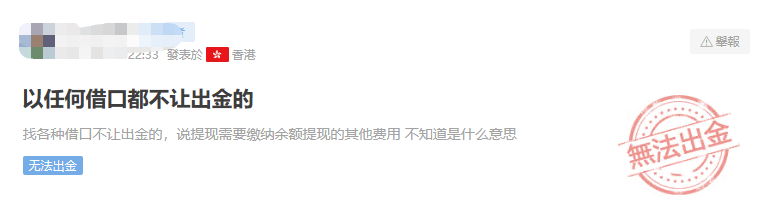

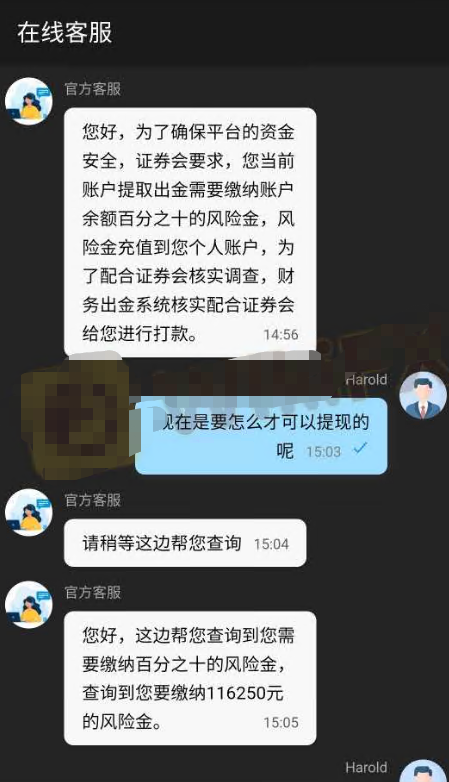

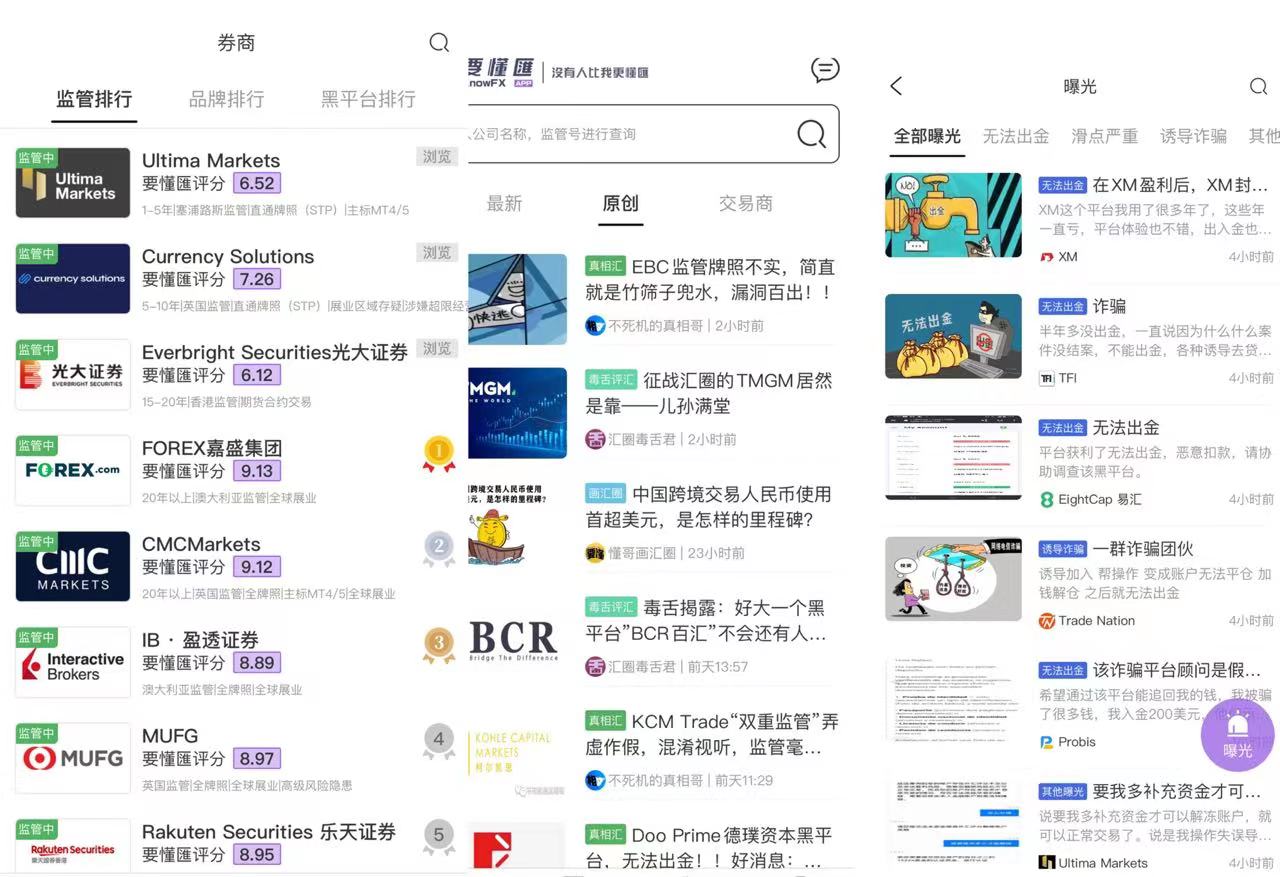

1. There are a large number of guest complaints!Don't give gold!Slide is serious!

Detective information began to conduct related search information on the Internet based on the customer complaint information received in the background. It was found that Ruixun Bank had a large number of guest complaints. Not only did they not give gold, but also high handling fees, serious slippery points, etc.For all kinds of thunder points, the types of Basically all the types of the customer have taken advantage of the type of customer!Why is Ruixun Bank obviously the second largest bank in Switzerland, but can do these things so boldly?

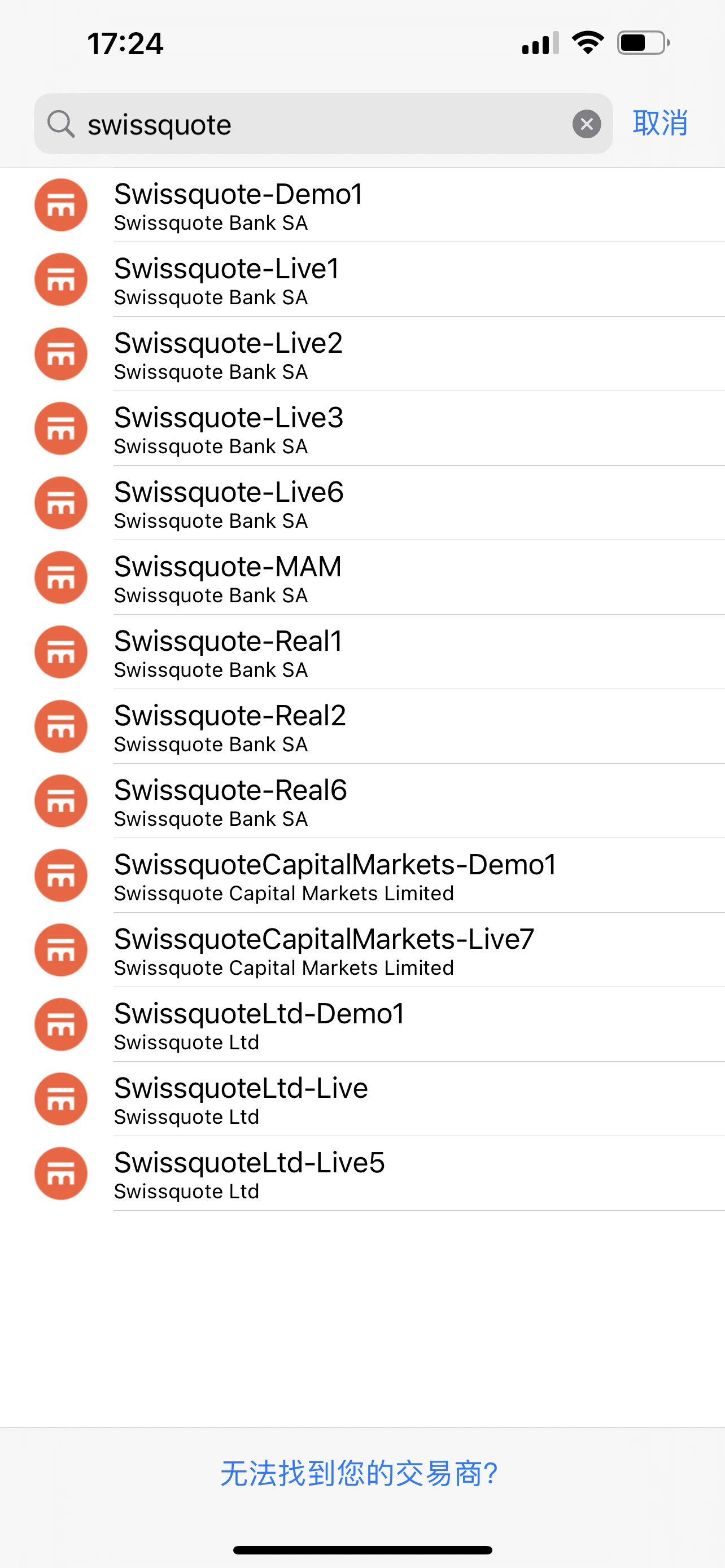

Companies that have traded in MT4 are supervised

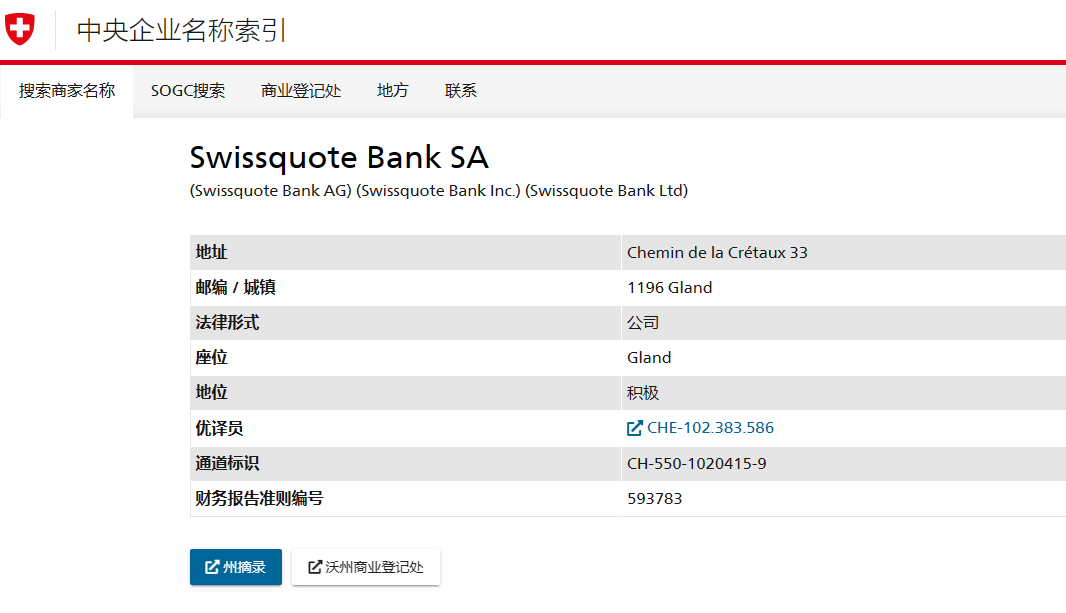

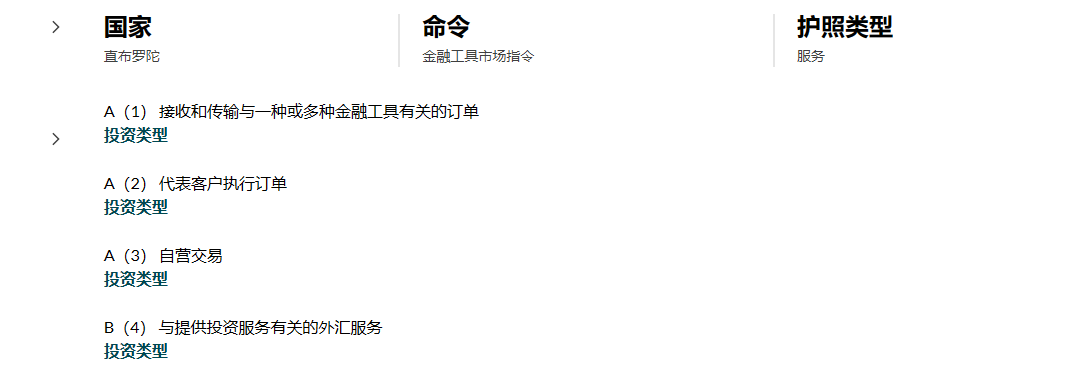

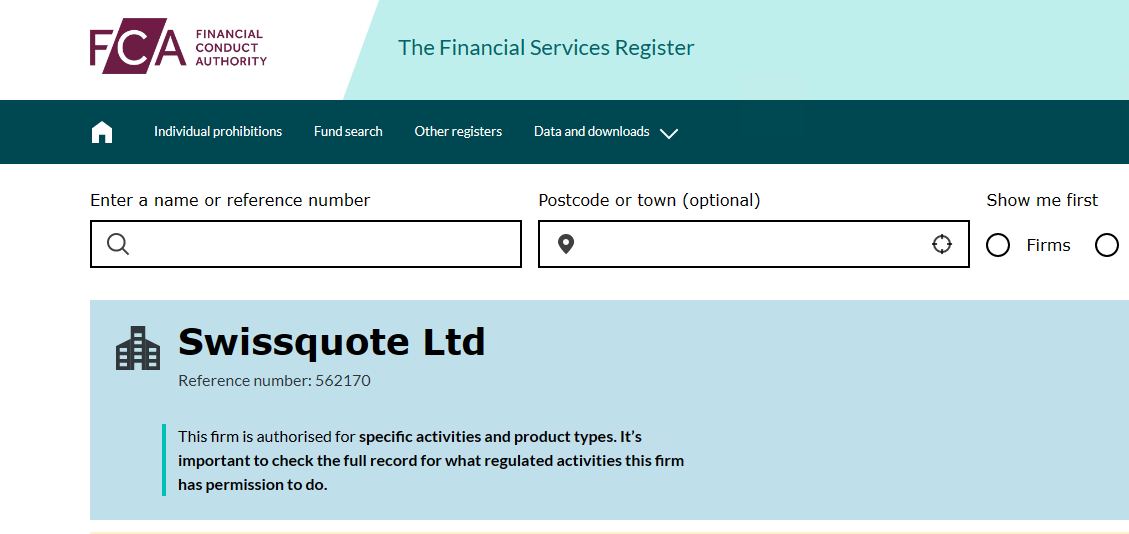

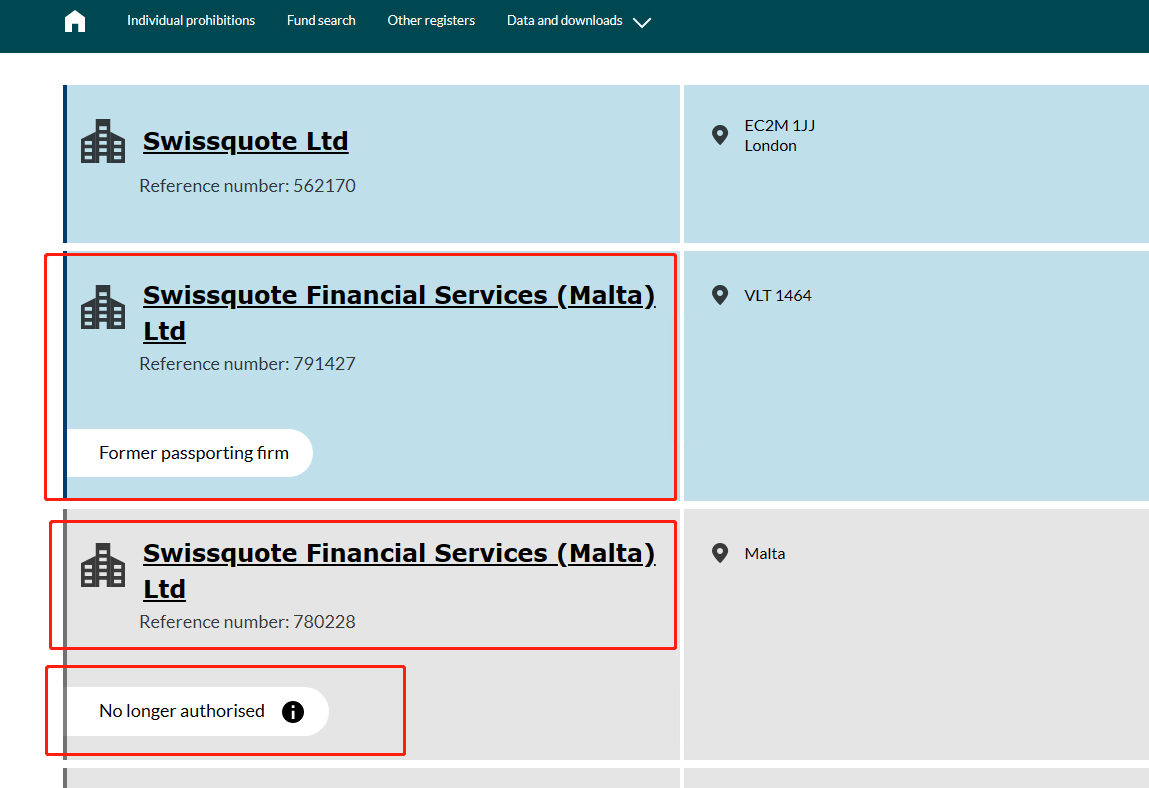

There are three companies that traded in MT4 in Ruixun Bank, which are Swissquotebanksa, Switzerland, SwissquotileMarketslimited in Cyprus, Swissquoteltd.

Swissquotebanksa in Switzerland is regulated

SwissquotecapitalMarketslimited in Cyprus

Swissquoteltd in the UK.

Ruixun Bank's supervision of trading companies on MT4 is okay. Investors are very trusting in Ruixun Bank and dare to put funds on Ruixun Bank.But Ruixun Bank used this trust to hit a rake to cause investors to be passive?Intersection

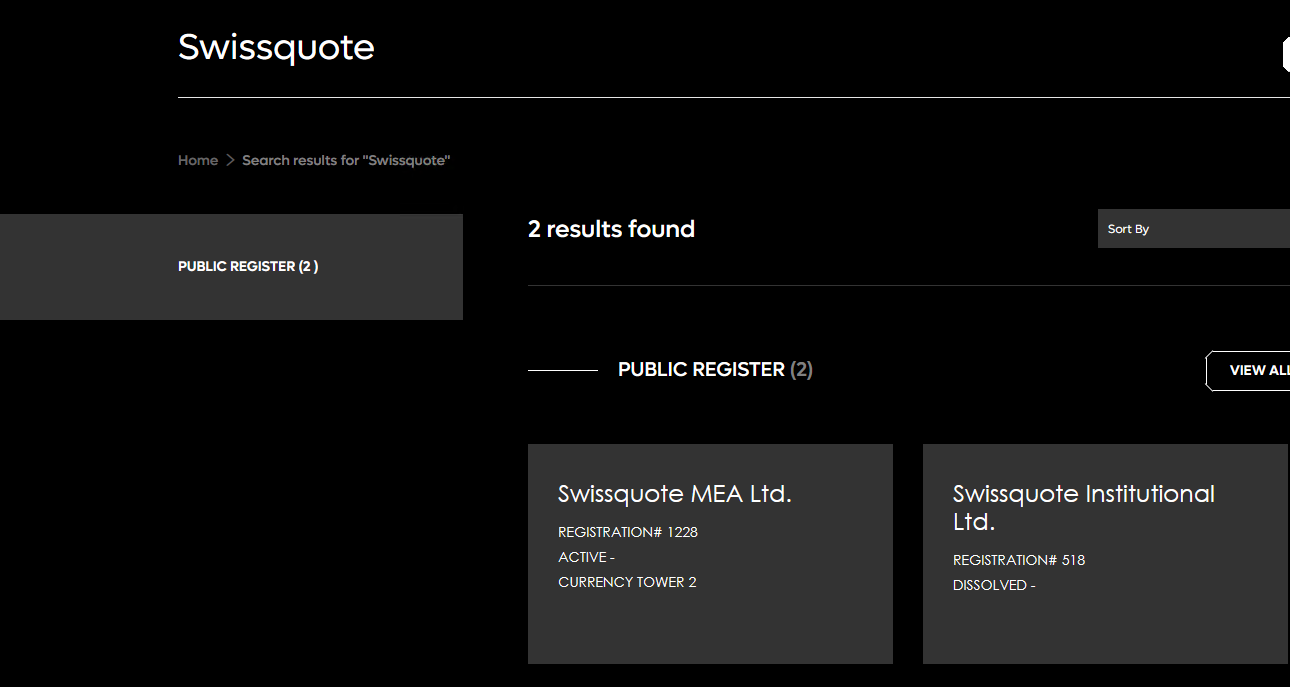

3. Ruixun Bank's company in Dubai has no foreign exchange transaction regulatory license license

DIFC inquiries in Dubai to have 2 companies

The first company: there is no foreign exchange transaction supervision, only allowing financial information, etc.

Second company: dissolved

What business did these two companies do?What is the existence of these two companies?

4. Ruixun Bank also has its own web version of the trading platform

If there is no problem with the supervision of Ruixun Bank MT4, then Ruixun Bank's own platform will be prone to problems.Because the whereabouts of funds are not guaranteed, it is likely that companies without foreign exchange regulatory licenses on Ruixun Bank's own platform have traded, and investment risks have greatly increased!

5. Swiss regulatory agencies actually understand and recognize the platform's slippery behavior!

Swiss regulatory agencies rarely punish slippery behaviors.Switzerland's laws believe that the platform has no obligation to strive for the best price as possible for customers. Therefore, under the condition of insufficient liquidity, the transaction of sharp slippery points can be accepted and understood by Swiss regulatory agencies.

So this is the unscrupulous slide point of Ruixun Bank!Do not give the root cause of gold!

There is supervision, but the regulatory agency recognizes this behavior, and the regulatory agency cannot give truly effective supervision.This situation is difficult to do, even if the investor may have no chance of winning!

There were such examples in 2019.Simply put, the Swiss Banking Supervision Committee believes that under the condition of forced liquidation, customers will not be able to forcibly ask for delivery at the target point, but need to consider the offer of the liquidity supplier at the time.

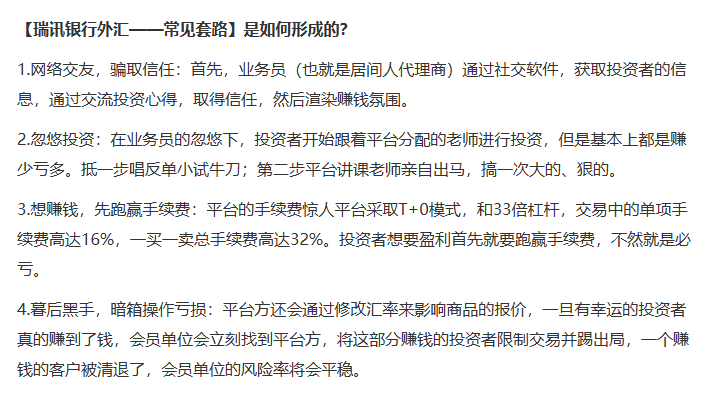

6. Ruixun Bank's routine

After watching this, I believe that investors will be more rational!

Investment needs to be cautious!Please brighten your eyes!

✉ Notification:

已 To understand that the current market has been launched, users can download the iOS version and Android version through the QR code sweeping noodles:

P By understanding the "Exposure" channel to understand the exchange app:

讯 More information such as brokerage information ranking and other information is to understand remittances: