Introduction to icmarkets

ICMARKETS is a Australian online foreign exchange and difference contract CFD broker, which was founded in 2007.It provides a variety of trading products such as foreign exchange, goods, indexes, stocks and cryptocurrencies.It is famous for its fast and low -point execution speed and low point, and has been favored by many traders.In terms of security, securities firms ICMARKETS is supervised by Australian Securities Investment Council ASIC and provides customers with reliable supervision and protection.

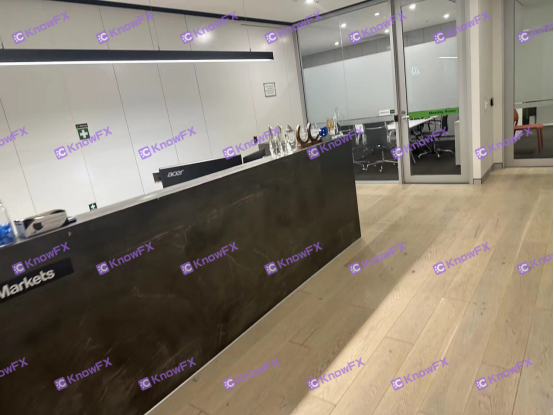

Our detectives go to the ICMARKETS Australian parent company where the location of the Australian parent company is located.

Detective visited the internal environment of the IC company, clean and tidy, and the staff was complete, leaving a deep impression on the detective.But if you want to see the good or bad of a broker, you can't just believe in the surface!After receiving regular supervision, there are problems with investors who have local rights protection. This is the most useful!

Concentrate

However, these are praise from domestic investors to icmarkets!And now the wind review reverses!The praise from investors to ICMARKETS has become a complaint ...

Sliding points seriously lead to explosive positions, close customer accounts without authorization, change customer accounts to collect handling fees, and suspected system problems and cause liquidation!Even the speed of order execution that is proud of is greatly reduced. The speed of gold is now slow. It often takes a week or more to get the account!Intersection

So today I will explore what ICMARKETS is?Intersection

Trading platform

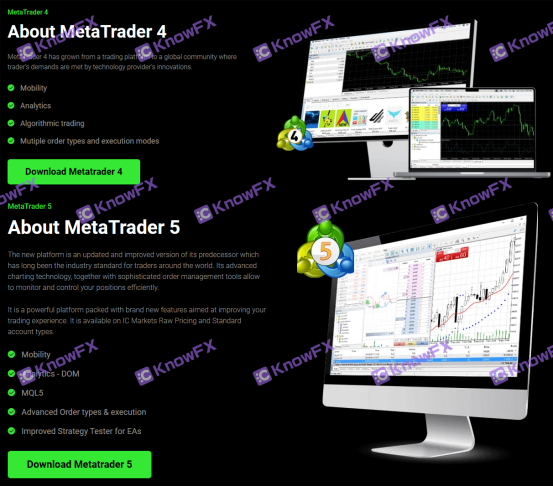

First let's take a look at the trading platform provided by icmarkets.

It can be seen from its official website that it can be traded on the CTRADER platform and MT4/5 platforms, and at the same time, it can meet the multi -terminal and multi -platform transactions of computer phones.But the good or bad of the two is not the point of today, I wo n’t go into details about it.

The focus is on who is the company that ICMARKETs trades on the trading platform, and where they are responsible for where they are supervised!

It is well known that MT4/5 is the most mainstream trading platform today, and it is also a trading platform commonly used in our domestic trading market, so today we will look at who is the company that is traded in the MT4/5 trading platform!Intersection

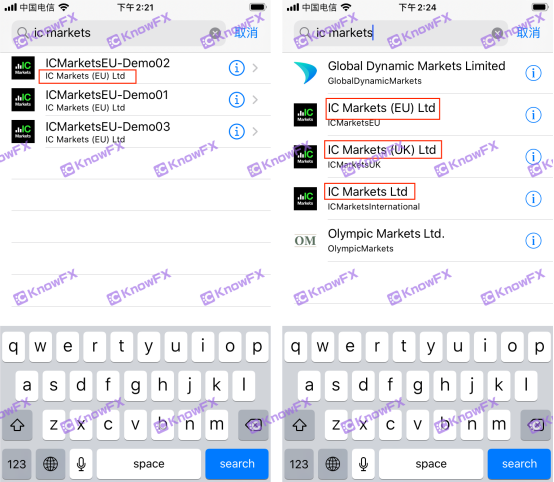

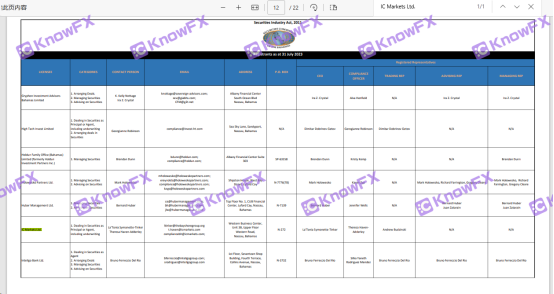

After understanding the verification of Brother, ICMARKETS has three companies traded on MT4/5, which are:

Icmarketsltd

Icmarkets (UK) LTD

Icmarkets (EU) LTD

Regulatory license

LICMARKETSLTD

Among them, the company's iCMARKETSLTD is located in Bahamas and is supervised by the Pahara Securities Committee SCB.

However, the transaction authority of Bahamas SCB to ICMARKETSLTD: "It is a client or agent for securities transactions and underwriting." So through its securities transactionsThe flow of regulatory funds is relatively opaque, and the security of its funds is relatively low.

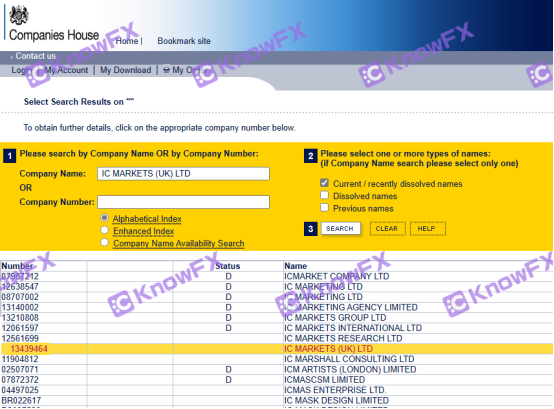

LICMARKETS (UK) LTD

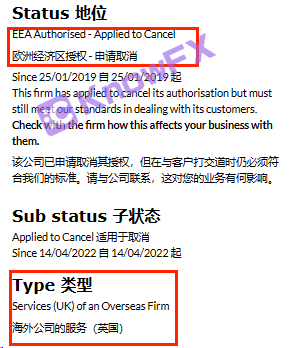

The ICMARKETS (UK) LTD is a company registered in the UK and is supervised by the British FCA, but I know that my brother must remind you here!Intersection

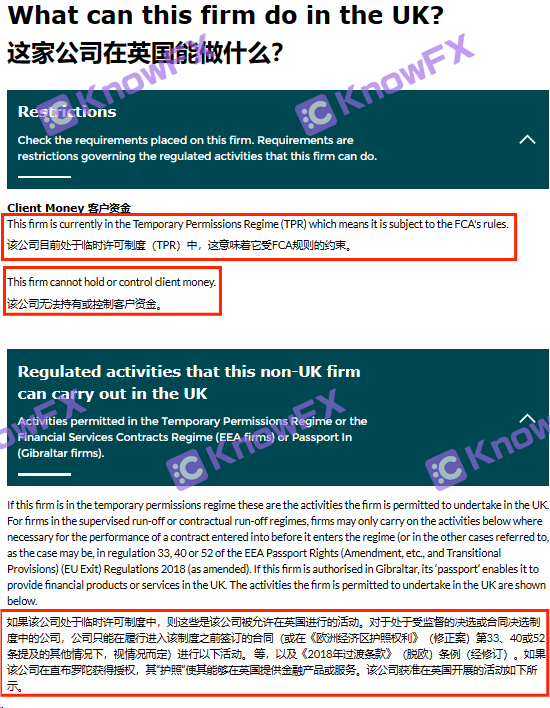

ICMARKETS (UK) LTD cannot hold or control cash, and it is in a temporary license. This state is essentially a special regulation!It was proposed by the financial jurisdiction caused by Brexit. The transactions conducted by the company under this clause will be supervised by the British FCA, and this clause can be legally operated in the European Union after applying for the European Economic Zone authorized.It is also supervised by the British FCA.

However, the company ICMARKETS (UK) LTD has not been authorized by the European Economic Zone. Therefore, it will only be supervised and protected by the British FCA in the UK.Unknown risks are generated. If you know, you are reminded, please choose this channel to invest in transactions!

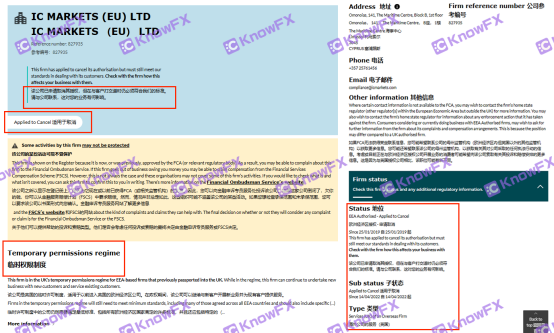

LICMARKETS (EU) LTD

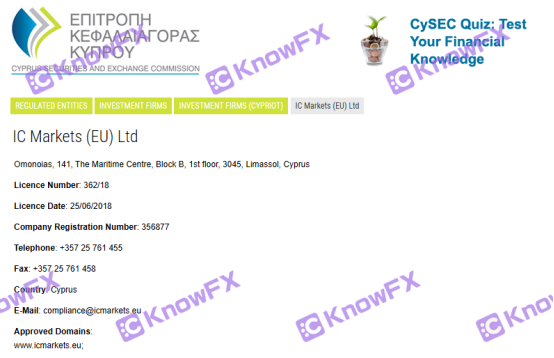

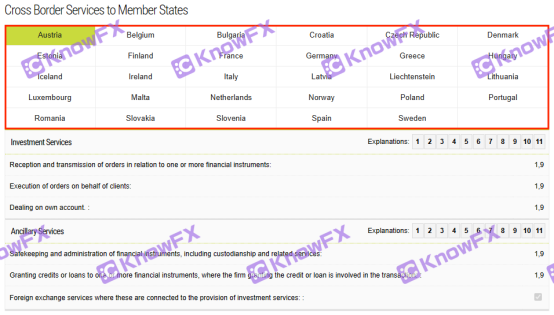

Finally, the iCMARKETS (EU) LTD is registered in Cyehston Securities and Trading Commission CYSEC.

However, Cyez CYSEC mainly serves European customers and has a relatively complete cross -border service rules and a clear scope of service. This obviously does not include China.Out of consideration for the security of domestic investors' funds, I know that when I know that when I see the license appearing during the transaction, I need to be vigilant and choose carefully!

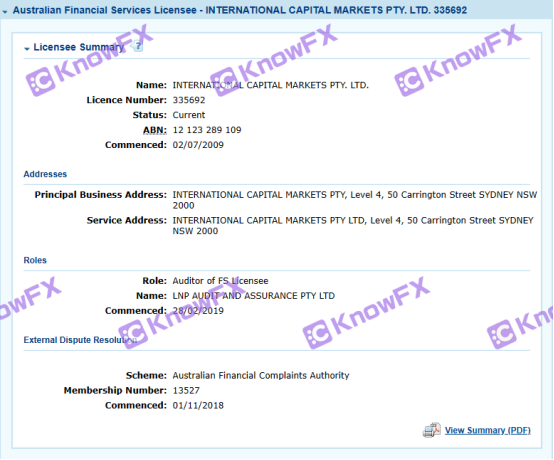

l Australia ASIC and Seychelles FSA

Finally, talk about ICMARKETS's ASIC and Seychelles FSA license. This is important "because the two are closely related to domestic investors"!

As we all know, ICMARKETS is an old Australian broker and holds Australian ASIC license!When icmarkets first entered the country, investors used the AU account of ICMARKETS, which is the Australian account.However, Australian regulatory agency ASIC's new regulatory regulations promulgated in 2019: Foreign exchange and differential contract brokers under the supervision of ASIC prohibit the acceptance of overseas customers.

Affected by this, after more than a year, domestic customers missed Australian AU account after all.On September 25, 2020, ICMARKETS stopped providing services to customers in mainland China. At the same time, affected customers can choose to close their positions in advance, or choose to transfer their accounts to iCmarkets Seychelles for supervision.

At the same time, it also means that the company, RAWTRADINGLTD, supervised by Seychelles, should bear most of the domestic investors' transactions!But obviously whether this parent company in Seychelles or in Australia has not traded on MT4/5!

Summarize

The above content makes it great to understand Brother!RAWTRADINGLTD, which was originally responsible for most domestic transactions!Obviously still under the supervision of the Seychelles FSA, why can't it be traded on the MT4/5 platform now?

At the same time, ICMARKETS is also surrounded by negative topics such as deleted orders, changes, differences in point differences, disappearance of executives, and disappearance of customer service ... and so on.Three companies that traded on the MT4/5 platform are limited by regional and authority scope of supervision and legal.

This shows that its current safety hazards are great!Know that Brother needs to remind investors to raise awareness of crisis and be alert to the possible risks!